mygoldenbee.ru Overview

Overview

Best Credit Cards For Low Fico Scores

Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Get Your FICO® Score · Learn About Credit · Respond to a Mail Offer · View Sample. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. Capital One Quicksilver Secured Cash Rewards Credit Card · FIT™ Platinum Mastercard - $ Credit Limit · Credit One Bank Secured Card · Credit One Bank American. In summary, the Discover it® Secured Credit Card offers a powerful combination of credit-building benefits and cashback rewards. With its low initial deposit. Check your credit score. Discover shows your FICO® Credit Score9 for free, so you can track it. · Apply for the Discover it® Secured Card · Pay credit bills on. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. The Discover it® Secured Credit Card is our pick for the best credit card for bad credit, since it's easy to get approved for, offers cash back and provides. Some of our picks ; Rewards. AvantCard logo. AvantCard ; Cash back. Credit One Bank® Secured Card logo. Credit One Bank® Secured Card ; Intro bonus. Delta SkyMiles. Best for limited credit: Capital One Platinum Credit Card. Here's why: The Capital One Platinum Credit Card can help you establish a positive credit history. Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Get Your FICO® Score · Learn About Credit · Respond to a Mail Offer · View Sample. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. Capital One Quicksilver Secured Cash Rewards Credit Card · FIT™ Platinum Mastercard - $ Credit Limit · Credit One Bank Secured Card · Credit One Bank American. In summary, the Discover it® Secured Credit Card offers a powerful combination of credit-building benefits and cashback rewards. With its low initial deposit. Check your credit score. Discover shows your FICO® Credit Score9 for free, so you can track it. · Apply for the Discover it® Secured Card · Pay credit bills on. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. The Discover it® Secured Credit Card is our pick for the best credit card for bad credit, since it's easy to get approved for, offers cash back and provides. Some of our picks ; Rewards. AvantCard logo. AvantCard ; Cash back. Credit One Bank® Secured Card logo. Credit One Bank® Secured Card ; Intro bonus. Delta SkyMiles. Best for limited credit: Capital One Platinum Credit Card. Here's why: The Capital One Platinum Credit Card can help you establish a positive credit history.

Best for Overall: Discover it® Secured Credit Card. Why we love this card: While rewards shouldn't be your top priority when choosing a credit-building card. Petal® 2 “Cash Back, No Fees” Visa® Credit Card *: Best unsecured card for bad credit. Capital One Platinum Credit Card: Best for building credit. Petal® 1 “No. Travel cards with premium benefits typically require a good or excellent credit score to qualify. · The Capital One Platinum Secured has a $0 annual fee and no. Top-tier or "excellent" credit starts around and gives you a good chance of being approved for credit cards and other loans. Your credit score is. The DCU Visa® Platinum Secured Credit Card is a secured card for bad credit, but it offers a lower interest rate than many unsecured cards for people with good. FICO Scores (the most widely used scoring model) range from to - Poor; - Fair; - Good; - Very Good; +: Excellent. Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit · Capital. Don't close old credit card accounts or apply for too many new ones. You can sign up for credit monitoring services quickly, and they will help you keep on top. score and put you on a path to improve your financial quality of life. Elevating a FICO score into the fair or good range opens borrowing opportunities. Credit Cards for Bad Credit / Rebuilding Credit Score · Self - Credit Builder Account with Secured Visa® Credit Card · Revenued Business Card · OpenSky® Plus. In most cases, a secured credit card is the best option for someone with bad credit because secured cards are easier to get and much less expensive in the long. Then, your search is over. These credit cards for bad credit are designed for lower credit scores. Find the right card now FICO® Score · What Is a Good Credit. If you prefer a secured credit card with a low deposit requirement, this card is a good choice. With responsible card use – including on-time payments – you can. Secured credit cards tend to be a good option for those looking to build or rebuild their credit. And with consistent, responsible use, you can improve your. Good builder/rebuilder cards are Discover and Capital One. Both creditors offer pre-approval tools that won't require a hard pull prior to. The best travel and cash-back cards typically require a good to excellent score, while the Discover it Secured Credit Card is designed for those with bad credit. Credit cards for good credit require a FICO score between to When used responsibly, they will help you grow your score and provide access to premium. Click APPLY NOW to apply online · New feature! · No credit check to apply. · Looking to build or rebuild your credit? · Get free monthly access to your FICO score. With 15+ years of experience reporting on credit cards, we've selected the Capital One QuicksilverOne Cash Rewards Credit Card as the best credit card for fair.

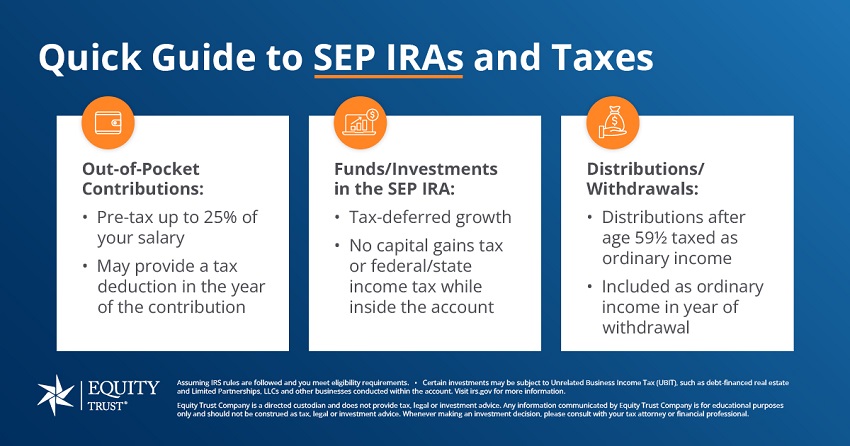

How Does A Sep Ira Work

A SEP-IRA is for anyone who is self-employed, has employees, or earns free-lance income while holding a job. Learn how to set up your SEP-IRA today. How It Works The employer must first establish the plan. Then the employer can make tax-deductible contributions on behalf of all eligible employees into. A SEP-IRA is a traditional IRA that holds contributions made by an employer under a SEP plan. You can both receive employer contributions to a SEP-IRA and make. While you work, your SEP account is also working. With compounding, earnings Merrill, its affiliates and financial advisors do not provide legal, tax or. A SEP IRA is a powerful retirement account used by many self-employed persons and business owners. It is particularly attractive as you can contribute up to. How does a SEP IRA work? A SEP IRA appeals to many business owners since it does not need many start-ups and operating fees like most traditional employer-. Under a SEP, an employer contributes directly to traditional individual retirement accounts (SEP-IRAs) for all employees (including themselves). A SEP is easier. How does a SEP IRA work? Individual employees do not make contributions to a SEP IRA, but rather the company owner contributes all the funds into the employees'. With these plans, small business owners can contribute toward their employees' retirement, as well as their own retirement savings. A SEP-IRA is for anyone who is self-employed, has employees, or earns free-lance income while holding a job. Learn how to set up your SEP-IRA today. How It Works The employer must first establish the plan. Then the employer can make tax-deductible contributions on behalf of all eligible employees into. A SEP-IRA is a traditional IRA that holds contributions made by an employer under a SEP plan. You can both receive employer contributions to a SEP-IRA and make. While you work, your SEP account is also working. With compounding, earnings Merrill, its affiliates and financial advisors do not provide legal, tax or. A SEP IRA is a powerful retirement account used by many self-employed persons and business owners. It is particularly attractive as you can contribute up to. How does a SEP IRA work? A SEP IRA appeals to many business owners since it does not need many start-ups and operating fees like most traditional employer-. Under a SEP, an employer contributes directly to traditional individual retirement accounts (SEP-IRAs) for all employees (including themselves). A SEP is easier. How does a SEP IRA work? Individual employees do not make contributions to a SEP IRA, but rather the company owner contributes all the funds into the employees'. With these plans, small business owners can contribute toward their employees' retirement, as well as their own retirement savings.

A Simplified Employee Pension (SEP) plan may work well if you want a low-cost, easy-to-maintain retirement plan for you and your employees. Both SEP IRA and. With this type of retirement plan, the employer must contribute equally for all eligible employees into their individual retirement account (IRA). What is the. The benefit is that the portion of your Roth contributions distributed in retirement are tax free. If you already own a SEP IRA, you don't have to open a new. A simplified employee pension plan (SEP) IRA is a flexible retirement plan for business owners, employees, and self-employed people. Get started with a SEP. A simplified employee pension (SEP) IRA is a retirement savings plan established by employers for the benefit of their employees and themselves. How does a SEP IRA work? With an LGFCU SEP IRA you only need a $25 minimum contribution to open your account. After that you're required to maintain that $ You make deductible contributions directly to individual retirement accounts (SEP-IRAs) for yourself and your employees. · Participants may rollover or transfer. It allows employer contributions, which traditional and Roth IRAs do not, and all contributions to it are tax-free, meaning that distributions in retirement. SEP IRAs are retirement accounts for small business owners and self-employed individuals, allowing them to make tax-deductible contributions toward retirement. Administrative costs for SEP-IRAs are relatively low compared to other retirement plans. And once it's in place, a SEP is pretty simple to operate. A trustee. Under a SEP, an employer contributes directly to traditional individual retirement accounts (SEP-IRAs) for all employees (including themselves). A SEP does not. How does a SEP IRA work? A SEP IRA is an employer-sponsored retirement plan often used by small business owners and self-employed individuals. Any business. SEP IRA plans are funded solely by employer contributions (employee deferrals are not permitted); each eligible employee generally receives the same percentage. For self-employed people, a SEP IRA works much like a traditional IRA or Solo (k)—but with a higher contribution limit. If a business owner brings on. Like traditional IRAs and (k) plans, the earnings in a SEP IRA aren't taxed until withdrawn, at which time distributions are considered ordinary income. SEP IRAs must be established and funded by your tax filing deadline plus applicable extensions. How to make contributions. You may generally deposit checks by. A retirement account for the self-employed · Contribute up to $69, · Help offset your income taxes · Shorten your to-do list · Want to compare a SEP IRA and Although available to businesses with any number of employees, SEP IRAs often appeal to small businesses with few or no employees. Employers have complete. SEP IRAs offer tax benefits to employees and employers. · Employers offering SEP IRAs can make the participation requirements less restrictive than IRS. Contributions are also tax deductible, up to a certain amount. How does a SEP IRA work? SEPs can be attractive options for small business owners because.

2 3 4 5 6